The world's economy is now in crisis. Import prices and consumer prices have been steadily rising, as the dollar-won exchange rate has soared abnormally. As the pandemic status gradually retreats, demand is soaring. The supply and demand of various raw materials have become imbalanced. Finally, the cost of production and distribution has risen, leading to inflation. With the war between Russia and Ukraine added to this, the world is suffering from inflationary problems. To alleviate this, the Bank of Korea and the central banks of other countries are implementing measures to raise the benchmark interest rate through monetary policy.

The correlation between interest rates and inflation

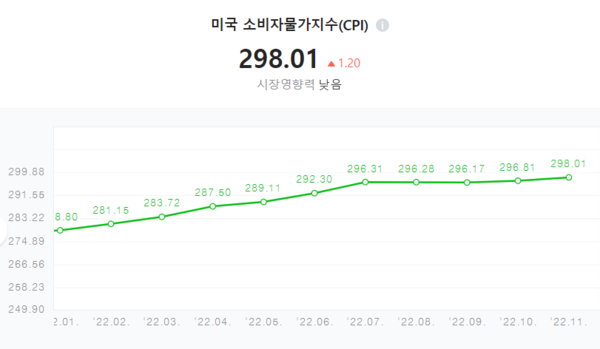

Korea is suffering from inflation as the dollar-won exchange rates have recently risen to the 1,400 won level. In the case of Korea, the economy changes greatly depending on the exchange rate, since it is a country that is heavily affected by exports and imports. For example, if the exchange rate rises sharply, Korea will have to pay more when importing, and inflation occurs when prices rise. According to the September Export-Import Price Index released by the Bank of Korea on October 14, import prices rose 4.9% in September from the previous month.1) The figure is 24.1% higher than a year ago. The main reason for the rise is international oil prices. Currently, oil prices have fallen due to reasons such as the global economic downturn and a decrease in industrial activities caused by COVID-19, while import prices have risen as the U.S. dollar continues to rise. The reason why the U.S. exchange rate is so high is that the inflation situation in the U.S. is serious. In September, the U.S. consumer price index (CPI) rose 8.2% year-on-year. The U.S. has taken 'giant steps' three times since June to lower prices, and the Fed, the U.S. central bank, is likely to raise its benchmark interest rate again. The 'giant step' is to raise the benchmark interest rate by 0.75%p, but the U.S. may continue to raise already high interest rates to curb inflation.

Analysis of the causes of inflation in the U.S. vary slightly from economist to economist, but the biggest reason appears to be concerns about the economic downturn caused by COVID-19. The U.S. predicted that the unemployment rate would rise due to the spread of COVID-19. The U.S. issued bonds to lower interest rates and help small business owners and the market economy to eliminate Americans' loan difficulties. This is because the state usually issues bonds when money is needed, and the central bank of the state can accumulate money by purchasing them. However, if interest rates are cut in this way, the value of money will decrease, which will inevitably cause inflation. The U.S. is raising interest rates to solve this problem, which is affecting Korea's high interest rates. Since Korean currency is not a key currency, unlike the U.S., it has to hold foreign currency for international transactions. So, if the value of Korean currency is lower than the dollar, foreign investors in Korea will withdraw their money due to the risk of monetary loss.

U.S. interest rates grabbing the world economy

Korea's trade balance has been in the red for six consecutive months amid the continuing strong dollar, and the economic situation in Korea is still not improving. The U.S. interest rate hike trend is not going away easily, as the rise of interest rates and rising prices are putting pressure on the public. According to the Bank of Korea analysis, prices rise 0.006% if the exchange rate rises 1%.2) As the Bank of Korea raised interest rates from August last year, prices were expected to fall, but the CPI is still rising more than 5%. The CPI rose 5.6% in September, slightly lower than in August (5.7%), but core prices rose 0.1%. The core price is the price index calculated by excluding items with severe price fluctuations depending on the economic situation. If the core price rises, the government raises interest rates to lower them. In the case of South Korea, as the rise in import prices causes inflation, the Bank of Korea raised interest rates to solve this. However, the core prices are still rising higher, and the burden on the public is getting worse. In response, on October 13, Prime Minister Han Deoksoo said, "Korea has to follow the Fed hike to some extent so that money can't flow out of the Korean financial market."3) In other words, it is vital to South Korea that interest rates be raised in order not to be excluded from the international market.

However, if interest rates continue to rise like this, the burden on households who received loans will inevitably increase. According to the financial sector on September 19, the floating rate of mortgage loans based on the new COFIX of the five major commercial banks (KB, Shinhan, Hana, Woori, and NH) is between 4.44% and 6.4%.4) Since variable lending rates are due to loans whose interest rates vary depending on the economic situation, if interest rates rise, borrowers will have to pay more. For household loans, the variable interest rate is 78%, and about 8 out of 10 people will be burdened by rising interest rates. According to the Bank of Korea, the household credit balance in the first half of this year was 1,869.4 trillion won, the highest since the 2003 statistics. The Bank of Korea surveyed the Consumer Composite Sentiment Index (CCSI) at 88.8 in August. If the CCSI is less than 100, it is interpreted to mean that consumer sentiment is pessimistic, reducing consumption. The crisis is that this kind of situation is not only visible to consumers, but also to companies. According to 'October Economic Trends' published by the Korea Development Institute (KDI), the BSI, an analysis of entrepreneurs' judgment on economic trends, plunged from 82 in September to 73 in October. This shows that corporate investment sentiment is cooling down. The nation's top 10 companies announced that they would invest 1,000 trillion won in the five-year term of the Yoon Sukyeol government in May, but a large-scale investment project scheduled for the second half of this year has been postponed until next year.

Countries that are greatly affected by U.S. policies, including South Korea, similarly have open markets and are dependent on foreign countries. In countries with high market openness, there is a risk that money will be withdrawn due to interest rate differences if its stance of the Fed is not met. Therefore, such countries must have higher interest rates than the U.S. in order not to lose money. The U.K., which has recently been suffering from a plunge in the pound and a sharp rise in government bond rates, is an example of this problem. The value of the U.K. pound, after the government announced a massive tax cut on September 23, plunged because investors sold U.K. government bonds due to the spread of concerns that the U.K. government would issue large scale government bonds to raise the necessary funds. In response to the market's reaction, the U.K. is currently talking about an emergency rate hike and the intervention of the International Monetary Fund. The economic crisis has also been seen in Japan as the yen's value fell below 147 against the dollar, the lowest in 32 years. At the end of September, the Japanese government intervened directly in the foreign exchange market by purchasing yen for the first time in 24 years. Bank of Japan Governor Haruhiko Kuroda said, "The Japanese economy is recovering slower than the U.S. economy, so it is not appropriate to switch to monetary austerity. I will continue to pursue a negative interest rate policy."5) The policy is to actively induce loans for the people to boost the economy. However, criticism has also been raised that this policy is unlikely to be realized in reality.

Kristalina Georgieva, the president of IMF

A number of steps to tackle inflation

Dealing with the current worst inflation situation, the Bank of Korea took a 'big step' in July and October. On October 12, the Bank of Korea's Monetary Policy Committee began raising the benchmark interest rate by 0.5%p at a time. As a result, Korea's benchmark interest rate has risen to around 3% in the 10 years since October 2012. This is attributed to the widening interest rate gap between South Korea and the U.S. as the Fed has taken the 'giant step' three consecutive times. This is because consumer prices have risen steadily, and as the won weakens and the strong dollar continues, import prices have to be controlled by raising interest rates. Lee Changyong, the governor of the Bank of Korea, said, "I'm well aware that the pain of the people is increasing in the process of the rise in interest rates recently. However, it is inevitable to prevent greater losses to the economy as a whole."6) He added that the degree of response will be determined after fully checking how changes in external conditions, including the monetary policy stance of major countries, will affect domestic prices and foreign exchange markets. Accordingly, if the U.S. continues to raise interest rates, Korea is also expected to raise its benchmark interest rate. As such, Korea is responding to inflation and high exchange rates by grasping the monetary policy stance of major countries and increasing the benchmark interest rate.

Not only Korea but also the Fed is coping with inflation through a rise in interest rates. Starting with a 0.25% increase in the benchmark interest rate in March this year, the Fed aggressively raised interest rates by 0.5%p in May, and 0.75%p in June, July, and September. In addition, at a meeting in September, the Fed revealed the interest rates would be raised to 4.4% at the end of this year and 4.6% next year. It suggests that this high-intensity tightening will continue for a while. Following the Fed, the European Central Bank also took a similar step, raising the interest rate by 0.75%p for the first time since the introduction of the euro. Meanwhile, the probability of the U.S. falling into a recession is growing. The Bank of Korea's Research Bureau released the report "Risk Assessment and Implications of an Economic Recession in the U.S. and Europe" on September 14, in which they estimated that there is a 15% probability that the U.S. will fall into an economic recession within the next year. The Bureau cited the continuation of high inflation, a rapid increase in interest rates, and the Fed's excessive or insufficient policy responses as the risk factors. Kristalina Georgieva, the governor of the International Monetary Fund (IMF), explained, "The rise in interest rates is costly for growth, but if interest rates are not tightened enough to control inflation, it will cause further damage to growth."7) She stressed that raising the benchmark interest rate in each country could lead to a recession, but that intensive tightening of finances should continue because controlling inflation is the top priority.

However, the rise in interest rates around the world is bound to bring a number of problems. Since there are many external variables such as the Russia-Ukraine war and the fiscal austerity stance of major countries, it is not clear whether the measures of each country can be a solution to calm prices. In particular, if the U.S. continues to raise interest rates sharply, the gap between South Korea and the U.S. could widen again, causing the value of the won to fall again. David Malpass, the president of the International Bank for Reconstruction and Development (IBRD) said, "What I'm really worried about is that the situation of the economic slowdown will continue next year. This situation could be especially hard for people in poor countries."8) This means that developing countries with small dollar reserves and heavily indebted to foreign countries could face considerable difficulties due to the continuing rise in interest rates. On October 3, the United Nations Conference on Trade and Development (UNCTAD) urged central banks in each country to stop raising interest rates. Also, they pointed out the measures currently being implemented would not help ease inflation. As inflation is caused by supply problems, it is necessary to implement policies to expand supply, not hold back the demand. In July, Russia and Ukraine agreed to export 1 million tons of grain, lowering global grain prices by 1.4%. It seems that efforts to eliminate inflation factors through increased output rather than excessive interest rate hikes will fundamentally help to solve this.

When will the global economy stabilize?

Inflation is negatively affecting all aspects of households, businesses, and governments around the world. As the vicious cycle of economic flow repeats, many experts predict that recovery will not be easy. Opinions are also divided on whether measures to raise the benchmark interest rate in each country can be a desirable solution to inflation. It seems to be necessary for countries not only to consider their own advantages but also to try to prevent the current situation from leading to a long-term economic downturn by targeting positive flows in the global economy.

1) Bank of Korea, Export-Import Price Survey, Import Price Index (Basic Classification)

2) Yu Hyosong, "Next Month, U.S. Giant Step 97% Chance... Big Step Again in Korea?", Money Today, October 15, 2022

3) See Footnote 2

4) Lim Junghwan, "Loan Interest↑Purchasing Power↓… Consumption Contraction 'Emergency'", New Daily, September 20, 2022

5) Jung YounghyoㆍLee Gowoon, "On the Tension of "King Dollar"...the Value of the Yen Is the Lowest in 32 Years", The Korea Economic Daily, October 14, 2022

6) Kim Joonyeong, Yoo Jihye, and Park Sejun, "The Bank of Korea Has Raised Interest Rates for the First Time in History for the Fifth Consecutive Time… People Be Driven to the Edge of the Cliff", Segye Ilbo, October 13, 2022

7) Kang Byungchul, "IMF Governor Said, 'if the Interest Rates Are Not Raised Enough, We'll Suffer More Damage… Necessary Measures to Be Taken'", Yonhap News Agency, October 14, 2022

8) Lee Yongjoo, "The World Bank's President, 'The Recession Will Continue Next Year'", MBC News, September 19, 2022

Ju Kim Jiyeong / Reporter

smt_kjy@sookmyung.ac.kr

Lee Gayun / Reporter

smt_lgy@sookmyung.ac.kr