Countless people have difficulty managing their assets efficiently. Also, lots have trouble managing large scaled assets alone. Failure to manage one's assets could result in the loss of all assets. Then, where can people get help when the management of their assets is out of control? The asset manager is one who can help them. SMT met Kwak SangJun sub-branch manager at the Shinhan Investment Corporation Headquarters, who is working as an asset manager.

Before our interview begins, please introduce yourself and your work to our readers.

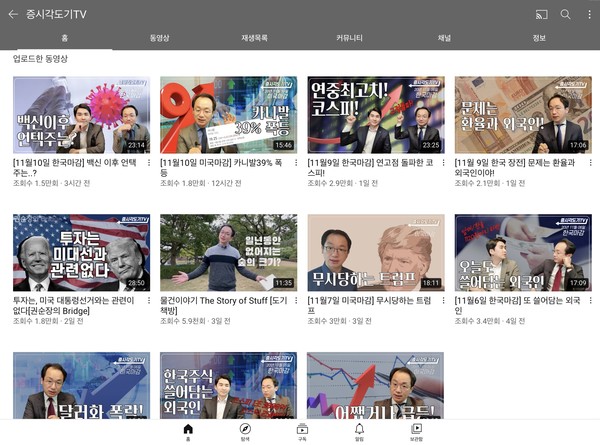

I'm the sub-branch manager of the Shinhan Investment Corporation Headquarters. My main job is to manage clients' assets, and although there are many ways to perform my job, I specialize in Korean stock investments. I also manage comprehensive assets, namely domestic bonds, overseas stocks, and overseas bonds. I am responsible for asset management in terms of financial investment, but I often also provide basic information on real estate and advice on related financial products. Last, I aid the branch manager, and I operate the YouTube channel <Jeungsigakdogi TV (Stock Market Protractor)>.

You have been working as an investor and an asset manager at Shinhan Investment Corporation since the 2000s. Please tell us the most important part when it comes to managing clients' assets.

The most important thing to consider when managing clients' assets is to grow reliably. The economy is constantly affected by inflation. That is, any capitalistic society is susceptible to inflation. It means that there is always the need to care for the decrease of monetary value, except in rare instances. Thus, assets management must consider responses to the inflation rate and economic growth rate to protect the loss of monetary value. Only by considering this can the value of money be kept. Making clients' assets grow over time without causing them any loss is important. To put it simply, maintaining a stable earning for clients is the most important thing in managing assets.

What do you consider the most important aspect of investments?

One of the important things to work in investments is creating a partnership with clients. Clients do not hire just anyone. They entrust their assets to me because they trust me, so it's really important to establish a partnership that enables us to work together effectively as I manage their assets. Another important thing an investment manager needs is a desirable attitude towards money. By improving one's skills, it is possible to constantly earn investment profits, but it is important to know that pursuit of money is not everything. While we all want good investment results, investors must not lose control of money.

As an investor for more than 20 years, what are some of your most memorable work episodes?

When I first started, I wasn't always good at asset management. There were times when it was overwhelming and I failed. I recall one client who was suffering from economic difficulties. I had a hard time managing his assets. He needed money urgently at the time, but his assets were significantly reduced, so he was suffering mentally. While he did not need a huge amount of money, he was desperate and in a really tough situation. I felt his emotion, too, and tried to treat him whole-heartedly. I am not responsible for a customer's financial loss in principle, but I recovered his financial loss personally. He recently contacted me and asked me to manage his assets again. I realized that even though bad situations occur during work, I should do my best for each client. I remember him because he allowed me to develop such faith in my beliefs.

Please tell us about your difficulties working in finance and how you overcame them.

Rather than talking about the difficulties of investing, I will say investing itself is very difficult, and it takes a lot of time to become a successful investor. It is necessary to do an apprenticeship, and if you meet a good teacher and train hard, your skills will develop over time. It is tough to earn money by investing unless you have honed your skills because the process is very difficult. Most of the people who started investing along with me have given up, and few people continue working as professional asset managers. Not to give up is to overcome. Successful people certainly exist, and I am here today seeing those successful people. Most investors give up, but I will not give up because I look up to successful investors such as Warren Buffett and Peter Lynch, and when I look at them, I see the way to succeed. Therefore, even if investing itself is difficult, I think not to give up is the way to escape difficulty.

What excites you to work as an investor and an asset manager?

Nowadays I am operating a YouTube channel, and from it, I have received a lot of great feedback. I feel good when individuals who are just starting out to invest say things like "Thanks to you, I survived difficulties during investing" or "Thanks to you, I made a profit". My YouTube channel is serving as a tool for communication with others. Therefore, I want to manage it earnestly. However, the most meaningful and valuable moments for me are when my asset management helps clients earn large profits. It is exciting to observe the happiness of others when the assets they entrust to me are successful. I also enjoy spending time privately with clients who want to have a meal or drink together with me.

This year, you released the book titled Attitude of Investment. What inspired you to become an author in addition to being an asset manager?

I started to write because of the need to organize my knowledge. I wrote the book out of curiosity to learn about how much knowledge I have acquired and how much I lack. Writing a book made me realize how much I really do know. Also, by writing, I wanted to collect all the background knowledge I got from books that I've ever read before. Reading books not only about investing but about a variety of areas is important. When investing, it is necessary to look around the world and understand how fast the world is changing. This can be done by reading books constantly. By providing my knowledge in a book, I hope I can also provide some key clues about investments to my readers.

On your YouTube channel <Jeungsigakdogi TV>, you summarize every day stock market conditions. Why do you think this is important to do daily?

There are a number of things to pay attention to before entering the stock market. Above all, it is important to focus on and comprehend the 'interest rate'. In particular, investors should follow the U.S. interest rates, which affect the global economy. Also, you should follow the U.S. central bank because it determines those rates. Most people are unaware of factors that determine the framework for stock markets. For this reason, I always try to emphasize the identification of the fluctuation of global interests and explain the macro-financial environment to my subscribers. In other words, I explain market conditions in order to point out changes in macro variables to understand the big direction of the stock market. Anyone interested in the stock market should focus on long-term changes rather than just struggling to make a short-term profit.

Your major while at university is philosophy. How did studying philosophy help you become an asset manager?

Philosophy is the study of people, the world, and the relationships among them. Therefore, I think philosophy helps me succeed in all that I do. Thanks to philosophy, I could view my career from a broader range and later moved on to a career in finance that I developed an interest in. Also, investing is not a simple mechanical system. It is an area where various people work. Without a direct understanding of people, attempting to invest using only mathematical calculations alone will lead to failure. Philosophy helps investors analyze people, and as such is helpful for investing.

Recently, university students have taken an interest in stock market investments. What advice can you give these young investors?

First of all, I would like to say, 'Don't give up' to all young investors. Most young investors hope for huge gains in short periods of time. Therefore, they usually stop investing when revenue doesn't come quickly. This behavior easily causes failure when investing. If you really want to succeed in the stock market, most of all, lower your target profitability. Until you toss away the thought of high profits, you will fail. I also hope you plan for the long-term. First, focus on building your investment techniques and become a master. You will see economic profits over time. However, keep in mind that the best way to become an investment master takes time and is not easy. Success requires a lot of patience.

Last, please leave some final tips for Sookmyungians.

I hope all students realize that this moment in time is the most meaningful time of your life. You will encounter many difficulties as a university student. Obviously, there will be situations when you fail, make mistakes, and you may even feel overly frustrated. However, knowing the precariousness of immature youth is a privilege that only young people have. Be sure to study a lot and try to have as many experiences as you can. Also, I hope you also consider all things that happen around you while at university. Remember being a young adult at university is most beautiful, perhaps more beautiful than anything else in life.

KWAK SANGJUN

-Graduated from the Department of Philosophy at Hankuk University of Foreign Studies

-Sub-branch manager at the Shinhan Investment Corporation Headquarters

-Operator of YouTube channel <Jeungsigakdogi TV>

-Author of Attitude of Investment

Kim Han Yujin / Woman Section Editor

smt_hyj@sookmyung.ac.kr

Kwak Lee Shinyoung / Woman Section Editor

smt_lsy@sookmyung.ac.kr