'Soul Taking' has become a new coined phrase, with the 'Donghak mom and pop Investor Movement', among the 2030 generation who are investors in the stock market. 'Soul Taking' means give your soul for a loan, and the 'Donghak Mom and Pop Investor Movement' represents large-scale buying by individual investors being at odds with large-scale selling by foreign investors, which is causing a sharp drop in stock prices. Together these two situations highlight the dangers of investing in the Korean stock market. Even with these circumstances, what attracts the 2030 generation to the stock market?

Hot potato of the younger generation

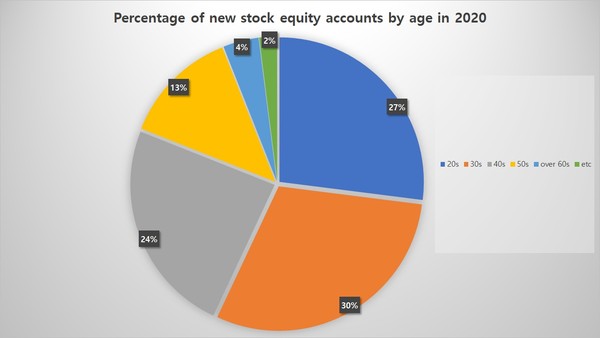

In the 1970s, when Korea was experiencing an economic boom, people had negative perceptions towards stock investments. Because people expected to earn high profits without working, many of them lost a lot of money due to high risk investments. In this respect, investment in the stock market was done without much consideration of the consequences, which brought about the idea that investing in stocks was dangerous. In the 2000s, however, Korea was hit by a recession. According to Korea Economic Research Institute, Korea's potential growth rate in 2000 was about 4.5%, but it fell to 2.5% in 2020. As a result, interest rates have also continued to fall, so it has become difficult to grow financial portfolios simply through savings such as term deposits and installment savings. Under these circumstances, people have begun to look to investing, and as a result, stocks have gained interest among people. In particular, the 2030 generation has increased its market share continuously since 2020. According to an analysis of stock accounts newly established in six securities companies this year, 57% of the 4.2 million newly established stock accounts were created by the 2030 generation.1) This finding indicates that the 2030 generation is getting interested in stocks and their numbers are increasing.

There are many reasons for buying stocks, for instance, to purchase a home in the future. One office worker who started investing in the stock market for the first time this year said, "I am seeking profits in order to make real estate purchases. With housing prices in the metropolitan area skyrocketing and the bank interest rate too low, I decided to invest in stocks so that I could earn enough to buy a home. I know that the risk is high, but if I don't do this, I may never have enough to buy a home."2) Park's remarks clearly show the problems facing the 2030 generation and the reason for stock investment. Soaring house prices, prolonged unemployment, strict real estate policies, and the economic slump caused by COVID-19 have it difficult to buy a house. Moreover, due to the decreasing interest rate, it is not easy to earn money only through savings. Consequently, young people look to stocks as a means of earning money. The analysis discussed above revealed the motivation for stock investment among the 2030 generation. According to comments on a survey of 5,757 people in their twenties and thirties, 33% of participants said, 'Earned income is not enough to increase one's assets and move up in society.' Another 30% said, 'Depositing money into the bank has become meaningless due to the extremely low-interest rate.' Uncertainty about the future caused by the economic downturn has created a stock investment boom for the 2030 generation.

Korea in this setting

Looking at the background for the stock investment boom among people in their twenties and thirties reveals the current economic situation in Korea. It is a sluggish job market that will not improve any time soon. According to the "2009-2019 Comparative Analysis of Youth Employment Indicators in OECD", the OECD average youth unemployment rate improved 4.4% from 14.9% in 2009 to 10.5% in 2019. However, in Korea, the rate only increased from 8% to 8.9%. As such, the job market for young Koreans is getting colder. The reality is that this year, rather than warming up, the situation has somewhat frozen due to COVID-19. According to Statistics Korea, the highest youth unemployment rate was recorded in the first half of this year. It was 10.7%, up 1.8% from last year's youth unemployment rate. In response, Professor Lee Sanggeun of Incheon National University, who examined the youth part-time job sector, said COVID-19 has brought about a greater increase in the number of unemployed people. Thus, he said young people will continue to struggle for jobs until the domestic economy, which at the moment is frozen by COVID-19, has been dealt with.3) Job shortages have amplified anxiety among those in their twenties and thirties and made them seek out the stock market. According to KB Securities, people in their twenties accounted for the largest portion of stock accounts created between January and August of this year. Other securities firms have posted similar trends, although the figures vary slightly. An increase in "credit offering balances" for loans as collateral has also noticeable increase among those in their twenties.4) In other words, those in their twenties and thirties are hoping that through stocks they can earn money. It has become one way to deal with the sluggish job market in Korea.

Besides job shortages, there are also various social factors that are responsible for the interest in stock investment. One is the low interest rate, which hoovers around the 0% range, and another is the era of long-term low-interest rates. To escape low-interest rates, young people hope to gain profits in the local stock market rather than keep money stagnant in bank terms deposits or through installment savings, even though investing in stocks is high risk. The best thing about a bank deposit is that it is, in principle, protected. However, some people also point out that stocks give a relatively higher return than deposits. Besides, the low-interest rate makes getting a loan easier than before, making ways to invest in stocks even if people don't have enough assets yet. Others are investing in stocks with the dream of one day buying a home. According to Kyunghyangbiz, "Even if one is just 5% successful, the investment has higher cost-effectiveness than labor." The average price of an apartment in Seoul rose from 7.0 to 22.9% in September while the average annual wage increased from 0.7 to 5.3% from January 2016 to July of this year. Therefore, frustration among young people with the real estate market has driven them to the stock market. In a meeting presided by President Moon, Moon said that the government should devise policy measures that ensure floating funds overflow into sound and productive investments, not into unproductive areas like real estate. Yoon Jiho, head of the research center at EBEST Investment & Securities, said that the government hopes to prevent funds released global from only entering the real estate market and to entice people into corporate investment. He also said the government is making various attempts to curb lopsided investment by establishing real estate regulations and new funds.5) Together it seems the government is encouraging people to invest in liquid assets productively rather than the real estate market, which could only cause housing prices to soar even higher.

What you know is not everything

Experts do not appear optimistic about more people in their twenties and thirties investing in stocks than before. They would like young people to pay closer attention to where they make investments. The stock market is booming this year due to the continued hardship brought on by COVID-19. Young people should consider both the short term, in an exceptional circumstance, as well as the long-term. While the stock market is easily accessible for the younger generation, they should not fall victim to crowd psychology. They must take into account this year's exceptional situation and look to the long-term by carefully planning for it. In fact, there have been many cases of loss due to misleading false stock advertisements claiming high returns. According to the Korea Consumer Agency, applications for damage relief related to stock investment rose 17.9% year-on-year to 204 in February of this year. It then rose 12.8% to 247 in March. The Korea Consumer Agency said people should be careful of advertising that promises a full refund when an investment fails to yield a high return or income is lost on the investment. People should sign a contract before signing up and properly check refund conditions.6) Therefore, it is not only important to be knowledgeable about stocks but to also avoid being led astray by crowd psychology or inaccurate information.

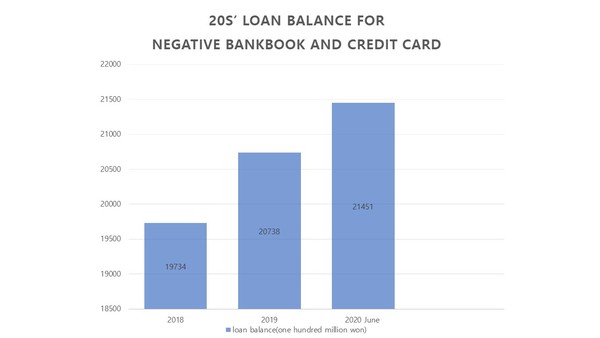

Concerns have also been raised about excessive investment rather proper asset investment by the 2030 generation. The coined term 'debt invest' has arisen to describe debts from 'Soul Taking'. In the first seven months of this year, 2030 generation borrowers accounted for more than 40% of total "minus bank account" holders, with nearly 4.7 trillion won (42,6000 dollars) in negative bank accounts according to the Financial Supervisory Service. Kim Sanghoon, lawmaker for People's Power, said "Young people rely on negative bank accounts because they have no choice but to respond to social factors such as job shortages and rising housing prices".7) However, they must guard themselves against the debt-for-debt craze. Debt investment increases not only individual investor losses but also harms security firms, resulting in a large amount of sales. Another problem with relying on debt investment is that it could lead to more debt if the stock price decreases. The investor falls into a vicious cycle of borrowing more money to pay back their loans even if they sell all of their shares. This leads to an increase in "can accounts."8) The younger generation should keep in mind that debt-ridden loans or "Soul Taking" can cause personal and social problems.

Investment by the 2030 generation, will it be okay?

The stock market investment boom among the younger generation was inevitable due to Korea's economic downturn. Moreover, the economic slump was worsened by COVID-19, so continued investment will not likely stop. However, if they engage in reckless investments, the Korean stock market will suffer. Therefore, for continuous proper stock investments, it seems that the 2030 generation needs to create a stable flow.

1) Ko Jaeyeon, "Missed Real Estate Last Train 2030..."Shares Are a Means of Survival," The Korean Economic Daily, September 2, 2020

2) Lee Wanki, "2030 Investment in Stock To Buy 'Youth Ant' House," Sedaily, July 28, 2020

3) Park Sejin, "The Employment Crisis Caused by COVID-19...More Severe for 'Youths'", Recruit Times, October 22, 2020

4) Lee Jungyoon, "Young People Filling Their Anxious With Stocks", Asian Economy, September 28, 2020

5) Kim Jamin, "With Low Interest Rates, People Are Crazy for Stocks, Half of All New Accounts Are Among the 2030 Generation...Dept Is Rapidly Increasing, Too", TV Chosun, August 20, 2020

6) Hong Joonki, "A Surge in Damages From Stock Investment Information Services... a Lot of People Are Refused Refunds When They Cancel the Investment", Chosun Ilbo, April 23, 2020

7) Park Jongseo, "Going Into Debt To Buy a House and Invest in Stock...forty Percent of Negative Account Holders Are Individuals in the 2030 Generation", The Korea Economic Daily, October 4, 2020

8) Kim Jae, "Is 'Soul Taking' Okay?" Newsis, August 24, 2020

Na Cho Seongah / Reporter

smt_csa@sookmyung.ac.kr

Sang Lim Hyeji / Reporter

smt_lhj@sookmyung.ac.kr