Global markets are highly sensitive to exchange rates. Considering exchange rates fluctuate according to each country's economic conditions, the United States and European countries are attempting to fight inflation and increase the value of their currencies by raising interest rates. The Bank of Japan, which had been cutting interest rates contrary to this international trend, is experiencing a weak yen as a result. This weak yen is having an impact on global currency markets.

The yen takes off its crown

On September 22, the value of the yen hit a record low of 145.89 yen to the dollar, the lowest in 24 years, resulting in a "super low yen" phenomenon. The weak yen is a phenomenon in which the Japanese currency, the yen, depreciates in international exchange rates. This means that if it used to take 1,000 won to buy 100 yen, it now takes 700 won. This has had mixed effects within Japan. For Japanese exporters, the depreciation of yen means that there is a lot of demand from overseas to buy their products at lower prices. In this regard, they can retain more dollars from foreign buyers and thereby increase their profits. Japanese automobile company Toyota experienced a 45 billion yen increase in operating profit after the yen currency depreciated by 1 yen. However, when it comes to importers, the lower value of the yen means that they have to pay a lot of yen to import things. As a result, the people in Japan have to pay more for imported things like food and gas than they used to. Also, the decrease in the value of the yen is causing inflation as the volume of currency increases and prices rise. About this situation, Moon Jung-hee, a researcher at KB Kookmin Bank, said, "The excessive weakening of the yen has significantly reduced its purchasing power, which can lead to a reduction in Japan's competitiveness. This highlights the weaknesses of the Japanese economy."1) It means that Japanese citizens, burdened by paying more money than usual, have reduced their spending, causing an economic downturn. The weak yen is having an adverse effect on households and imports.

The weakness of the yen is not only affecting Japan's domestic economy, but also changing its position in the international market. Until now, the yen has served as a key currency that is used as a standard for global trade alongside the dollar and euro. Therefore, the yen has held the status of a riskless asset, but this position is weakening as the yen's value is becoming unstable. According to the International Monetary Fund (IMF)'s "Real GDP Growth" report released in October, Japan's GDP is expected to decrease by 0.2 percent from last year. This is compared to 8.4 percent growth in Germany, which had similar GDP figures to Japan. This shows that Japan's economic situation is taking a hit compared to a country that has had comparable economic growth rates. The IMF noted that this is the result of Japan's inflation. This condition has led to concerns about the need for government intervention to address domestic and international economic issues in Japan. That is, reducing the amount of currency in circulation by raising interest rates to bring down high prices. In December 2022, the Bank of Japan moved to raise interest rates by widening the range of the long-term interest rate from 0.25 to 0.5 percent. Contrary to this movement, Kazuo Ueda, the new Governor appointed to the Bank of Japan, said, "The Bank will continue to persevere with monetary easing in the face of very high uncertainty in the domestic and international economy and financial markets."2) In other words, the Bank will maintain the current low interest rates under its monetary easing policy. With this direction in the Bank of Japan's economic policy, the weakness of the yen seems to continue.

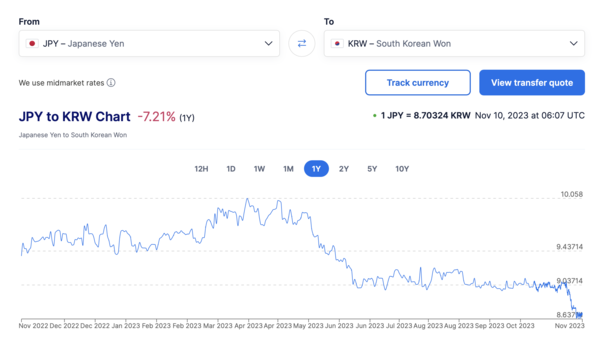

Chart of JPY to KRW

A chain reaction from past economic policy

The current monetary easing policy of the Japanese government has its origins in the economic policies of former Japanese Prime Minister, Abe Shinzo. This policy, called "Abenomics," began in 2012. It worked by increasing the amount of money in the economy to encourage people's spending and adjusting interest rates negatively to reduce people's savings. Overseas, the resulting weakness of the yen and ease of borrowing benefited exporters by encouraging them to invest more actively and enticing foreigners to buy more of their goods at a cheaper cost. This led to a virtuous cycle in which companies that earned more profits raised the wages of their workers, increasing household consumption and income. In other words, the policy intentionally induced a weak yen to expand exports. While Abenomics has led to improved business conditions for companies, as the policy's intentionally induced weakness in the yen continued for 8 years, it has also led to a significant depreciation of the yen, causing a recession as is the case in Japan today. As a result of this recession, the policy was abolished in 2020 when Abe Shinzo resigned. However, the yen's depreciation has continued under Prime Minister Fumio Kishida due to Japan's massive debt. Under Abenomics, the Bank of Japan injected currency into the market by issuing government bonds. This constant issuance to provide for the market has left the country unable to cover its expenses and led to an exponential increase in debt. According to the IMF's "Gross Domestic Product to National Debt Ratio," Japan's national debt ratio stood at 263.1 percent as of 2021, compared to 132.6 percent for the United States. With such a large amount of debt already accumulated, the IMF calculates that if interest rates are increased by even 1 percent to solve the weak yen, the additional interest payments on top of the debt will increase to about 3.63 trillion dollars in 2025. This indicates that the size of the country's debt is a major factor for the Japanese government to consider when it comes to adjusting interest rates. These conditions are making it difficult for Japan to change its economic policy.

Japan's deepening yen weakness is also linked to the U.S.' policy of raising interest rates. As the U.S. dollar is the main key currency for international trade and financial transactions, its policy has global implications. The U.S. Federal Reserve System has been raising interest rates steadily from March 2022 to May this year. This is to address the inflation that the U.S. is currently experiencing, and many countries, including Europe, are following their lead by choosing to raise interest rates as well in order to avoid the economic fallout. Contrary to this global trend, Japan has maintained a low interest rate policy considering the domestic situation, and the interest rate differential between the U.S. and Japan has been widening. In this regard, there is a move to invest in the U.S. with higher interest rates to increase yields. This causes the problem of the outflow of Japanese funds as it is more costly to invest in the weak yen. Criticizing this situation, Yukio Noguchi, the Japanese economist, said, "After 20 to 30 years of believing that a weak yen is good for Japan, Japan's growth engine has been diminished. The only way to stop this is to change the economic stance through the action of raising Japanese interest rates."3) In other words, experts are saying that Japan needs to end its monetary easing policy and reduce the interest rate differential between the U.S. and Japan in order to revive its economy. The rise in U.S.' interest rates is having a major impact on the fluctuations in the value of the yen.

Bank of Japan's Governor Kazuo Ueda

Korea's efforts to avoid getting carried along

The issues regarding the yen are a factor that is also affecting Korea's export sector. A weak yen can reduce the competitiveness of Korean companies competing with Japan for exports. The Export Similarity Index of Japan and Korea is 69.2, which is the highest compared to nearby countries. This means that Korea and Japan have a lot of common products that they compete to export, most notably semiconductors, steel, and automobiles. With so many overlapping export products, the weak yen makes it cheaper for other countries to buy Japanese products and reduces the price competitiveness of Korean companies. According to the "Impact and Implications of the Ultra-Low Yen on Korea's Exports" report released by the Ministry of Finance and Economy in November 2022, a 1%p depreciation of the yen against the dollar reduces Korea's export volume by 0.2%p and export price by 0.61%p. This causes a slump in exports, which plays a large role in Korea's economic growth. Commenting on the situation, Kim Jeong-sik, a professor at Yonsei University's School of Economics, said, "As Japan is likely to keep the weak yen for a long time to maintain export competitiveness, it is important to keep an eye on the impact of Japan's exchange rate on exports."4) This indicates that the Korean government and companies should make systematic export and investment plans in anticipation of a prolonged period of export weakness. Gaining an edge in export competition with Japan is considered to be a necessary factor for the growth of not only the export sector but also the entire Korean economy.

Korean companies are reacting differently to the ongoing weakening of their export competitiveness. Major companies are saying that the negative impact of the weak yen on exports will be limited due to their qualitatively competitive products. Illustrating this, the Hyundai Motor Company has overcome the weak yen by taking up the second largest share in the U.S. electric vehicle market in the first quarter, surpassing Japanese companies. However, unlike major companies that already have both technology and capital, Small and Medium-sized Enterprises (SMEs) in Korea are suffering in the international market. Due to factors such as low capital, it is difficult for domestic exporting SMEs to guarantee profits if the yen depreciation continues. In addition, they have less experience in overseas exports than major companies, which creates challenges in the process of production, distribution, and export. To promote their competitiveness, the Ministry of SMEs and Startups has set up the "Scheme on Export Support for Small and Medium-sized Enterprises" to support those facing difficulties due to changes in the economic environment. The center provides companies with information on changing trends in the export market and factors for enhancing competitiveness, helping them to cope with international trends such as the weak yen. The center also provides funding to companies that meet the required criteria such as the probability of success of the company's business plan. Despite the changes in the international export market, it seems that Korean companies are trying to maintain their competitiveness by utilizing the overcoming measures appropriate to their situation.

Chart of yen based export and import price

As a member of the global economic market

In the international economic market, each country's economic situation affects the rest of the world. The phenomenon of Japan's weak yen has attracted attention both inside and outside the country. The private sector in Japan has been calling for a change in the Bank of Japan's monetary easing policy to address the rise of inflation. However, a change in economic policy is uncertain due to the consequences of the prolonged interest rate cuts and the government's stance on expanding exports. Depending on whether the Japanese government decides to modify its economic policy in the future, it seems to be having a major impact on not only Japan but also the international economy.

Busan Port

1) Moon Hye-hyun, "Yen/Dollar Exchange Rate Surges 13% This Year to Hit 150 Yen...hindering Japan's Economic Growth [Moneymoney]", HERALD CORPORATION INC, October 28, 2023

2) Son Seo-young, "The Yen Hits 800 in 8 years...what's the Impact on Our Economy?", KBS NEWS, June 20, 2023

3) Kim So-yeon, "Japanese Economist "The Drug Called the Weak Yen, Low Interest Rate Policy Must Be Stopped"", The Hankyoreh, October 2, 2022

4) Ha Nam-hyeon, "Even With the Record of Weak Yen...Limited Impact on Korean Exports?", JoongAngIlbo, July 17, 2022